Being a business owner, it’s important to recognize the significance of small business insurance. It acts as a safeguard not only for you but also for your employees, customers, assets, and the long-term viability of your company. Considering the financial burdens linked to employee injuries, legal disputes, temporary business shutdowns, and cyber breaches, there is significant risk involved with opening your own small business.

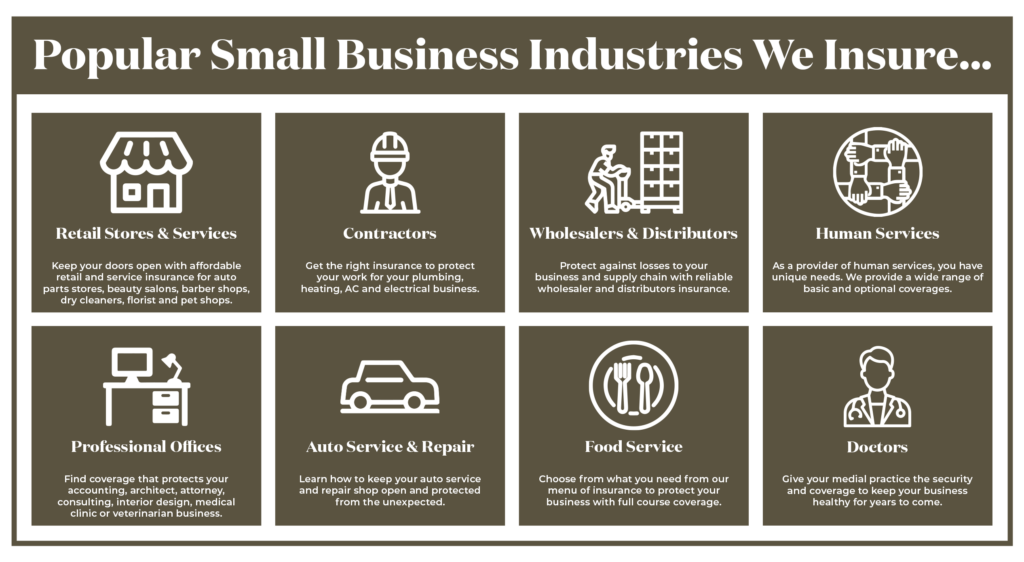

Without adequate business insurance, any of these scenarios has the potential to pose a serious threat to your business’s future. Moreover, your state might mandate specific types of business insurance coverage to ensure compliance with legal requirements. As a business owner, you need to protect yourself, your employees, your customers, your assets, and the future of your company. In every industry, our comprehensive business insurance solutions guard against a wide array of risks companies encounter each day.

The right commercial insurance coverage for your company depends on the kind of business you have. For example, a tree removal service working with potentially dangerous equipment would have different risks and needs than a freelance web designer. Another factor to consider is the location of your business. It’s important to talk to an R6 Integrity Group agent about your business to help make sure you have coverage that meets your specific needs.

R6 Integrity Group takes the stress out of insuring your small business! Contact our expert team today to get a free, personalized quote. We have the experience to help you find small business insurance solutions, specific to your situation. Don’t delay – find peace of mind by getting coverage for your business today!