Looking for a Dynamic Speaker to Inspire and

Educate Your Audience?

Danielle Richard is a passionate entrepreneur and

trusted financial expert dedicated to helping

businesses and individuals secure their future with

integrity. Danielle brings a heartfelt and practical

approach to financial security, offering insights on

retirement planning, insurance solutions, and

financial strategies tailored to the unique challenges

of today’s world.

At R6 Integrity Group, we understand that securing a successful future for your business means planning ahead. That’s why we specialize in setting up tailored retirement plans for businesses, utilizing the latest tools such as the SECURE Act 2.0 to provide optimal solutions. Whether you’re looking for 401(k) plans, Simple IRAs, or other retirement options, we offer expert guidance to help you choose the best fit for your business. Our mission is to provide solutions that are not only affordable but also help you attract and retain top talent by ensuring your employees have a secure financial future.

As a business brokerage with trusted partners, we are dedicated to helping all businesses, regardless of size or industry, navigate the complexities of retirement. In addition to retirement planning, we prioritize educating business owners and their teams on financial matters. By offering educational resources on employee benefits, investment strategies, and more, we empower you to make informed decisions that align with your long-term goals. With R6 Integrity Group, you gain access to personalized service, expert advice, and trusted partnerships to help your business thrive today and in the future.

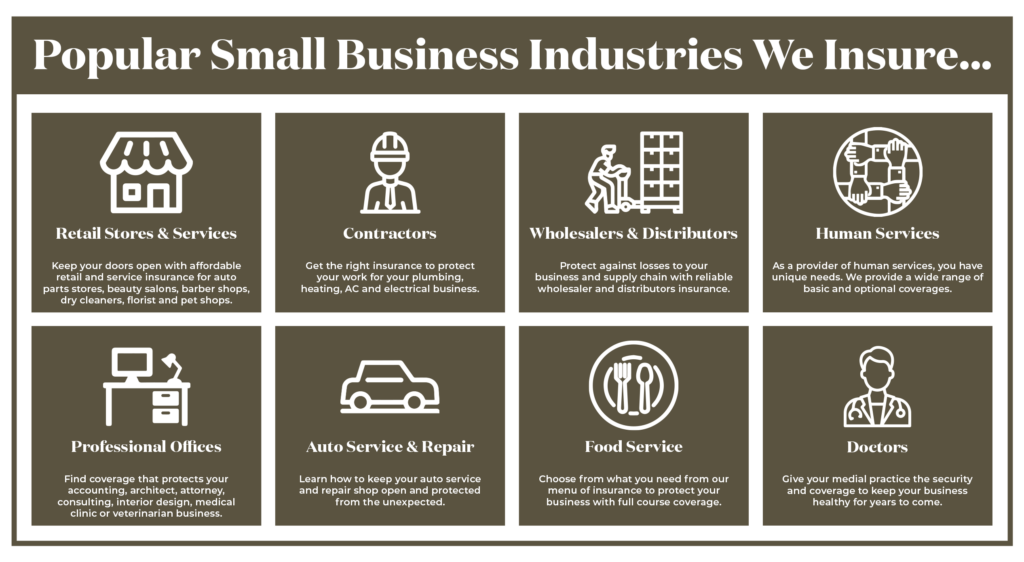

The right commercial insurance coverage for your company depends on the kind of business you have. For example, a tree removal service working with potentially dangerous equipment would have different risks and needs than a freelance web designer. Another factor to consider is the location of your business. It’s important to talk to an R6 Integrity Group agent about your business to help make sure you have coverage that meets your specific needs.

R6 Integrity Group takes the stress out of insuring your small business! Contact our expert team today to get a free, personalized quote. We have the experience to help you find small business insurance solutions, specific to your situation. Don’t delay – find peace of mind by getting coverage for your business today!